As an established brand, you likely have a sense of your products’ minimum and maximum prices. Your products might fall within those ranges by using a competitive pricing or cost-plus pricing strategy. These strategies are serviceable as they give you an easy-to-establish benchmark for your entire catalogue. Yet many of them forego the idea of Goldilocks pricing and the ability to find a price that is “just right.”

To achieve this at scale, many businesses like grocery stores, airlines, and Uber use dynamic pricing technology to keep their price up with demand.

What is goldilocks pricing?

Goldilocks pricing is a strategy that maximizes profit after production, warehousing, shipping, and other landing costs.

It is the optimal intersection between goods sold, and profit margin per product. Goldilocks pricing is built on the assumption that overall profit does not grow linearly.

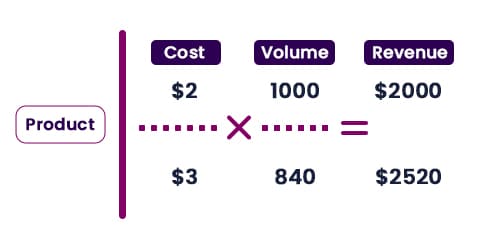

For example, if you start by selling a thousand pens at $2 you would see $2,000 in revenue. Now, inspired by this blog you increase the cost of your pens to $3 and you sell 840 pens, you’ve now made $2,520 in revenue. This is a non-linear revenue curve which suggests that you have some agency in generating new profitability through more effective pricing. Linear profit sensitivity would suggest that you would only sell 667 pens and that no matter what you would always make $2,000 in revenue.

While this is plausible based on your price elasticity, we can use an extreme case to illustrate why this is likely not true. Say we changed the cost of our pen to $2000, all we would have to do is sell 1 as an Amazon seller. However, assuming that this pen has the same features as a $2 pen, it is improbable that you would ever sell 1. This suggests that there are more efficient prices than others.

This rough analysis only gets more complicated when you factor in the production cost, and shipment cost, and start calculating the actual profit. These costs will inevitably make pricing your product too low unprofitable while pricing your products too high will lead to a dip in volume. The area between profit margins and volume is the goldilocks zone.

Many pricing strategies are not built to test the market for optimal pricing like dynamic pricing is. Dynamic pricing moves and responds to your data to find these areas of efficiency across your products.

Increase Your RoAS By 38%

These 3 Amazon pricing strategies will have your competitors scrambling to keep up.

How do Uber and Airlines use dynamic pricing to find their goldilocks zone?

Once you’ve determined the range of prices that are acceptable to your business and its long-term strategy, you are ready to start your dynamic pricing strategy. A manual process may require you to go and update the product’s cost based on certain variables. If you were running an airline, you may lower your prices during the winter months. If you were Uber, you may raise your prices during rush hour.

To do this, you would go into your retail systems and change the price as new requests for trips and rides come in. However, doing this manually could not keep up with the speed of their services. These businesses have access to automated dynamic pricing systems that change prices to match demand on a moment-to-moment basis.

For airlines, this helps them to address fixed costs. During slow periods, they are able to sell tickets cheaply to increase volume to cover the cost of fuel and staff that would be present regardless.

Uber often uses dynamic pricing to maximize profits. During their busy periods, they maximize their drivers’ output by raising their prices to the point where enough of their customers are still willing to pay. Ideally, their pricing technology is able to find a price that appeals to as many passengers as they have drivers. This way their drivers always have someone to drive and Uber is not providing a ride to someone that would happily pay more.

Dynamic pricing is a lot of work. If you have been trying to find your Goldilocks zone by manually adjusting your prices, you likely are losing a lot of time and of course, money.

Automate dynamic pricing.

Finding a Goldilocks zone manually might leave you filling in the gaps with guesswork and loosely researched reasoning. If you’re really keen, you may start at the ends of your price range and work towards your median, benchmarking your sales volume against your profit margins.

For some businesses, this might be where price discovery ends. Those who are keener may take a few more guesses and plot them against each other.

To alleviate this time-consuming and costly endeavour, our automated Dynamic Pricing technology democratizes the solutions airlines and Uber have been taking advantage of and brings them to Amazon sellers looking to grow their slim margins.

Our system is built to find your Goldilocks pricing and utilizes that benchmark to leverage other objectives when necessary. By asking for a few simple inputs from you, we can begin to build Pricing Profiles on each of your products.

These pricing profiles model your profit sensitivity so you can set optimal prices. As purchasing behavior changes, your prices will update to meet a fluctuating Goldilocks zone. To compound on this functionality, our system also factors in your landing costs and your competitors’ prices to ensure that your profit margins are being reflected appropriately and you are bidding competitively for Amazon listings.

If you want more information on how you can find your Goldilocks pricing you can request access below.

Increase Your RoAS By 38%

These 3 Amazon pricing strategies will have your competitors scrambling to keep up.